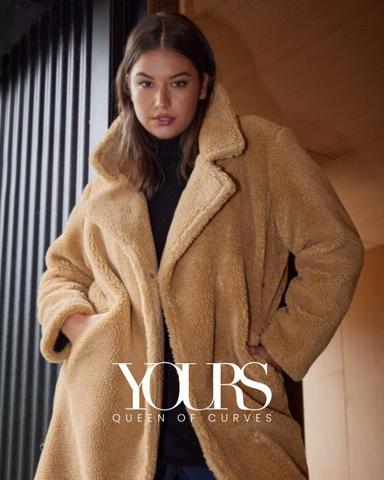

Shop Our Favourite Brands

Welcome to Wallis, your destination for Fashion and Accessories. A heritage name in British brands, look to Wallis for all of life’s essentials. Expect to find occasion-ready dresses, tops for the office and the shoes to match, plus new beauty brands that will elevate your daily routine. Your perfect fit is only a few clicks away, with Petite and Plus Size collections ready for everyone to love.